The smart Trick of Omaha Parking That Nobody is Talking About

Table of ContentsSome Of Omaha MapThe Best Guide To Omaha WeatherGetting My Omaha Address To WorkSome Known Details About Omaha Weather Get This Report on Omaha Location

The Creighton Bluejays likewise make use of Charles Schwab Field Omaha as their home area. Enjoyable Reality: Football fans might wonder why retired NFL quarterback Peyton Manning often shouted Omaha throughout games. Similar to government missions and business projects have code word, the Denver Broncos made use of the Nebraska city to call one of their plays.

Discover hours of operation, info concerning special exhibits, and a lot more at the Joslyn Art Gallery website. The Joslyn Art Gallery is closed until 2024 for a considerable development and renovation. Improved among the city's acmes with rounded belfry and a terracotta roofing, the Spanish Renaissance design of St.

And when it was completed in 1959, St. Cecilia's was one of the 10 biggest basilicas in the USA. People of all beliefs rate to enter this Omaha spots and stare up at the fancy plaster and mosaic ceiling, pay attention to the dual-temperament Pasi body organ, and appreciate the comprehensive stained-glass windows.

Our Omaha Ne Statements

to 6:30 p.m. To find out more regarding seeing the church, consisting of the Mass schedule, go to the St. Cecilia Catholic Sanctuary internet site.

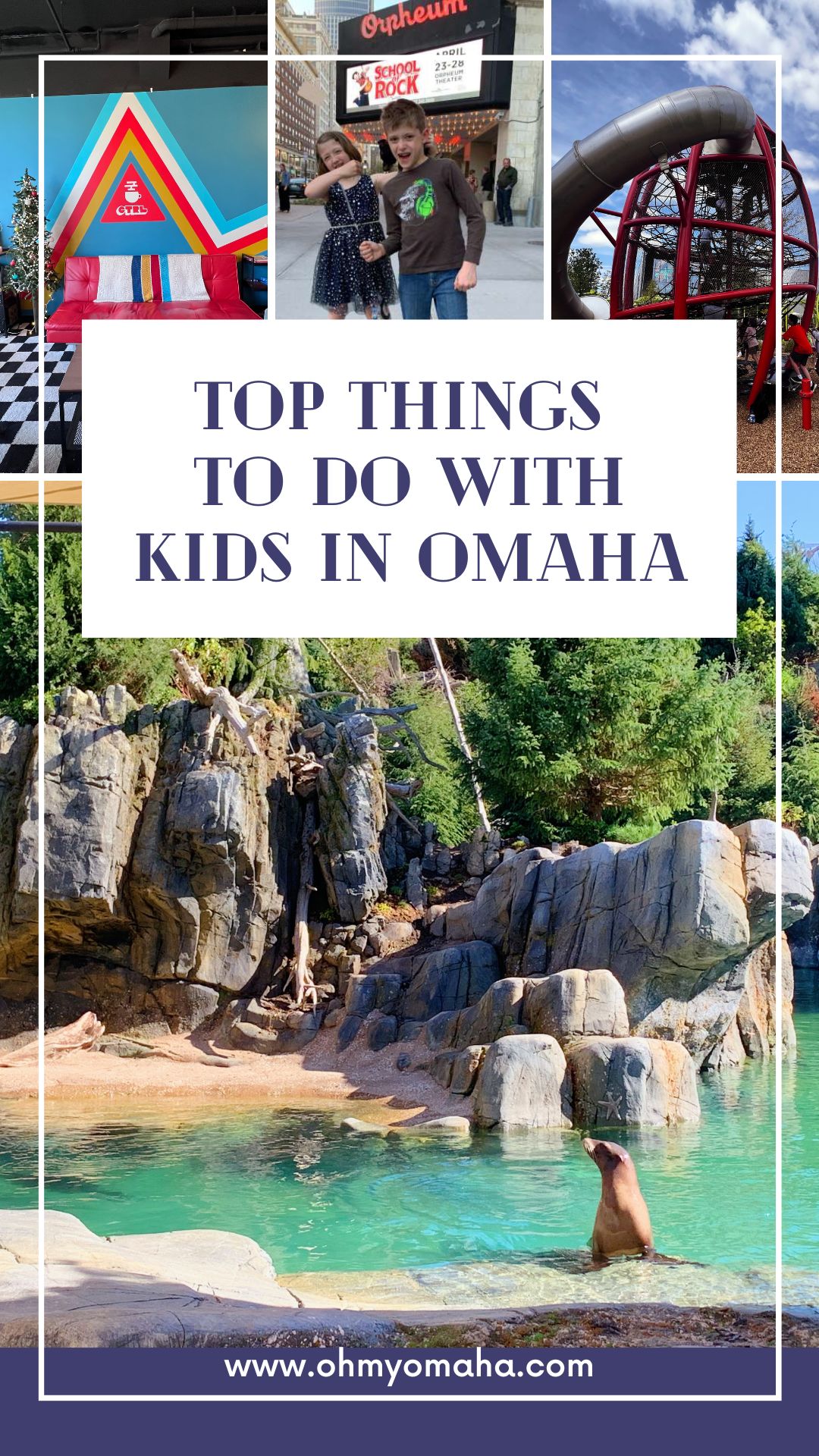

Within mins, you can be at waterfront parks and botanical gardens or even strolling across a bridge to one more state. Most of the important things to do in Omaha are family pleasant with a lot of tourist attractions to maintain the whole staff delighted. In the 19th century, the Latter-Day Saints created their method west via Nebraska on their method to Utah.

Site visitors will have the ability to discover about the trials and tribulations on their westward track, which assists to clarify the problems of life throughout this era. The visitor facility is incredibly insightful, with historic maps and artefacts from the expedition. Around Historic Wintertime Quarters, you'll additionally discover the Home Page Disaster of Winter Quarters, a sculpture by Avard Fairbanks along with the Mormon Pioneer Cemetery.

It's usual to incorporate your trip throughout the bridge with a long time in the immaculate park that commemorates the historic expedition of the popular travelers. Through the park, you'll discover insightful signs that take you back to the expedition and through the significant occasions. You can additionally check out the park's site visitor facility for a captivating 20-minute movie.

The Best Guide To Omaha

Cecilia's Sanctuary was completed in 1907. In the century because, it has actually become one of Omaha's defining sites. Set down on a hillside in the Gold Coast Historic Area, the cathedral is best understood for its embellished facade that includes 2 flanking bell towers. Inspired by Spanish Renaissance architecture, it's a striking view that stands over 220 feet high.

One of which depicts the Virgin Mary. The range of art installations stream right Extra resources into one an additional, creating an exciting story along the way.

If you're traveling with children, you'll enjoy Omaha Children's Museum. Not just is it wonderful for the little ones, great site however it will provide you a well should have break.

Getting My Omaha Hour To Work

Each display has a distinct motif that will certainly stir your kids' inquisitiveness, developing a fun and academic environment. There is likewise an array of short-lived exhibits and family-focused programs, specifically in the hectic summer season months.

Among those is the Bob Kerrey Pedestrian Bridge. Spanning 3,000 feet throughout the Missouri River, the bridge takes you from Omaha to Council Bluffs, Iowa. The spectacular cable-stayed bridge has been a major landmark since 2008. In the years since, it's been a precious place for exercise and obtaining to and from either city.

Cecilia's Sanctuary was completed in 1907. In the century considering that, it has turned into one of Omaha's specifying spots. Set down on a hill in the Gold Shore Historic Area, the sanctuary is best recognized for its embellished facade that includes two lateral bell towers. Motivated by Spanish Renaissance style, it's a striking view that dominates 220 feet tall.

The Facts About Omaha Map Uncovered

From beginning to end, you'll see the stories of wagons, men, females, and kids going across the rugged environment, in addition to a herd of bison. They integrate to create the biggest bronze and steel setup in the United States. If you're taking a trip with kids, you'll like Omaha Kid's Gallery. Not only is it terrific for the children, but it will certainly give you a well was worthy of break.

So it's additionally a fantastic alternative on a wet day. Each display has an unique theme that will certainly stir your children' inquisitiveness, developing an enjoyable and academic atmosphere. Some of the styles consist of arts, technology, zoology, and science. There is additionally a range of short-term exhibitions and family-focused programs, specifically in the active summertime.